Intellectual honesty

I’m thrilled by the reception of the newsletter and grateful for my crypto friends who shared the announcement. You make me proud to be part of this community. This morning I woke up inspired to write more, so here we go.

Today I want to explore the topic of intellectual honesty and its importance to succeeding in life and markets. Rationality and the ability to accurately assess one’s thoughts, theses and outcomes is essential to iterative learning. In a multivariate environment like markets, where most variables are out of your control, the only way to succeed in the long run is by consistently making bets of positive expected value, without going to zero. This is very hard.

Physicist Feynman says it well:

The first principle is that you must not fool yourself and you are the easiest person to fool.

There are many forces at play that make this so. Fundamentally, we’re not only rational creatures, but also emotional ones. We’re impacted by a range of cognitive biases, but more importantly, I think only few of us have cultivated a process of careful, incisive scrutiny of one’s decisions and thoughts.

Some of the common biases at work:

- Consistency bias: we’ve done x so want x to continue making sense, despite contrary evidence.

- Confirmation bias: you seek information to support your pre-existing belief.

- Seeking path of least resistance: our minds want to preserve energy and intuitively nudge you to take the easy route.

- Anchoring bias: your evaluation of something like a price is based on the number you’ve seen earliest or most often.

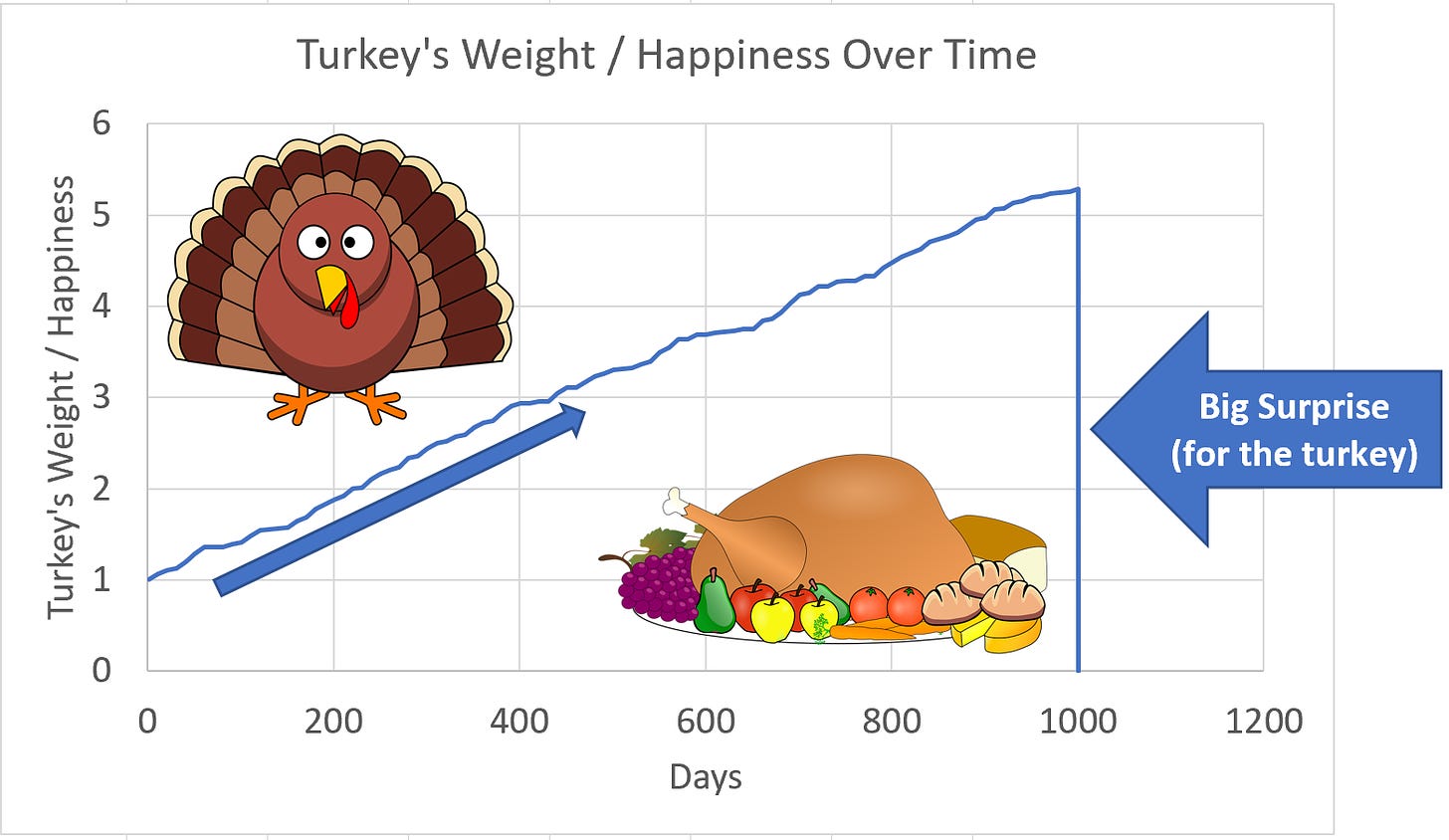

For investments and trades, the only way to get around this is to have a process that is factual, rational and subject to review and invalidation. Every investment or trade needs to be viewed like a hypothesis with odds and prospective gain and loss. There have to be validation and invalidation levels of both fundamental and price technical analysis. It’s taken me years to understand the importance of this and put it into practice. It clicked because without the ability to evaluate the outcome of a thesis to its arguments, I cannot judge my ability as an investor nor the validity of my investments. It’s entirely possible for an investor to come into the market, especially during a bull run perpetuated by low rates, and make great profits based on circumstantial luck rather than skill, leaving one overconfident and none the wiser. This breeds Nassim Taleb’s turkeys - and we must ensure that we never become one (yes, you’re going to see the turkey often).

Let’s take a practical example. I’m invested in Synapse ($SYN) because I believe in a multi-chain world where bridges are abstracted away and assets move freely across blockchains. Fundamentally, I think SYN has a 10x team that ships faster than their peers and that their omnipresence and pool depth will generate increasing returns to tokenholders. For this to manifest, they need to launch single-sided staking and eventually their DPoS chain where SYN will be needed to become a validator. As these milestones are hit (validation) I can average up or even increase my % portfolio allocation to the project. Inversely, if the team loses key members (Aurelius, Trajan), their pace vs. peers slows or prospect of tokenholder value accrual diminishes, I would have to sell or decrease exposure.

From a price action point of view, things get muddier. As a fundamental analyst I have a hard time having price action trump fundamentals. However my friend Aperture constantly reminds me that in crypto everything correlates on the way down, and that majors (BTC, ETH and some L1s) retain most value as people flee to them during adversity, while alts lose disproportionately. Not selling based on PA may result in holding tokens that are fundamentally undervalued but depreciating heavily - not a winning strategy. So contrary to my inclination, I must have sensitivity to price action and relative strength, as I’m trying to maximize my returns and outperform a simple BTC or ETH HODL. For price action, what matters then are the charts denominated on a USD and ETH basis.

Let’s look at SYN’s charts below.

Against USD, which I denominate in, SYN’s done OK. I’m a buyer around $1.5, $0.85 and $0.5, however if price breaks below $1.5 I have to force myself to sell since the way down to the next buy level ($0.85) is steep. At increments of $3, 3.5, $4.2, $4.8 I would take partial profits (10-30% at the time, always keeping a “moonbag”).

SYN’s performed well against ETH until mid October, but after that ETH went on a bit of a run and SYN hasn’t outperformed during ETH’s recent chop either. It needs a catalyst. Below the $0.004 level I would similarly have to sell, as ETH would be a better place for my money.

Price action invalidations are hard for me since the fundamental research I’ve done entrench me via a deep understanding of a project, belief about its future and cognitive biases like sunk-cost fallacy (I’m already invested), confirmation bias (I like it so will keep looking for reason to like it - even if cope), consistency bias (I tweeted about liking this so cannot capitulate now). However objectively, understanding that technical analysis is also a discipline of odds, I’m better off selling the invalidation level and rotating back at a cheaper price. I must thus become comfortable liking the asset but not holding the asset when it isn’t within fundamental (e.g. <20x FDV/Tokenholder Earnings) or price technical parameters (e.g. at $1.5 support so decent entry price) that are likely to be profitable.

It’s just terribly painful when adhering to such principles goes against you. It makes me want to choose blissful ignorance instead. For example, take Abracadabra ($SPELL), which I recently exited entirely since my PA invalidation level was hit. See chart.

Fundamentally, I believe we need decentralized stablecoins and that MiM is the less bureaucratic, more capital efficient (permitting interest bearing tokens as collateral) alternative to Dai. They are strategic about using emissions to attract TVL and have consistently shown willingness to reduce emissions and outstanding supply as MiM adoption grows, increasing attractiveness of holding and staking SPELL as fee earnings increase via borrowing/lending spreads, origination fees and liquidations. Daniele is also an Elon Musk-esque figure in the space, with upside being he’s able to shift narratives and downside that he may fly too close to the sun and have his personal stature be his undoing. SPELL was cheap when I sold it, approximately 8x FDV/TE (see my valuation spreadsheet here). Yet I had to do it based on the price action, since the chart’s a massive broken head and shoulders, volumes decreased and it broke key support with a 4H close below $0.008).

Lo and behold, a few days after my sell, some bid returned to the market, SPELL announced a 5% total circulating supply burn effective Jan ‘22 and Coinbase listed the token. Price pumped to +104% vs. USD today… OUCH. Forcing the question: was I right to sell?

I thought bid decreased for SPELL, which it needs lots of since people farm & dump the token used to incentivize MiM depth across chains. Many people farm with auto-compounders. OBV since mid Nov shows a negative trend and volumes were generally decreasing. Recent sell-offs (see big red bars) weren’t followed up with big green bars, indicating lack of appetite. I thought Daniele bullish sentiment blew over to the point where there weren’t enough buyers to sustain positive price action again and that people sold out rotating to safer assets. I wanted to re-enter after seeing a bottom form and OBV being flat or positive for a week or two. Factually, I don’t think any of the bullish events that have happened have negated this logic. However they do indicate that this team 1) consistently is delivering and trying to create tokenholder value and 2) that people are excited to come back and bid on positive news. What it doesn’t prove is that during current volatility, buy pressure will return beyond these one-off events to the point that price won’t drop to a local low again. Problem is… now I’m not holding something I’m fundamentally very bullish on, and by seeking safety I lost out on gains, whereas I could have added to weakness instead of sold. But would that have been the rational move? I think I acted justly. But would love your input - do you think I made the right decision? Why so, or why not? Let’s discuss.

I want to leave you with a concept I learned a while ago from Annie Duke’s book “Thinking In Bets”, which is that of resulting. That you shouldn’t judge the quality of your decisions by the outcome of those decisions, but by the soundness of your thinking instead. She comes from poker, where you can play a hand that’s probabilistically EV+ but can still result in a loss, but was the right play.

Striking Markets Newsletter

Reflections on blockchain, markets and venture capital.