The passive investor

I’m inspired by investors like Munger and Buffett (Berkshire), Li Lu (Himalaya Capital), their more modern day equivalents like Michael Shearn, Fred Liu (Hayden Capital) or crypto contemporaries like my friends Ace Da Book (To The Moon Capital) and GLC.

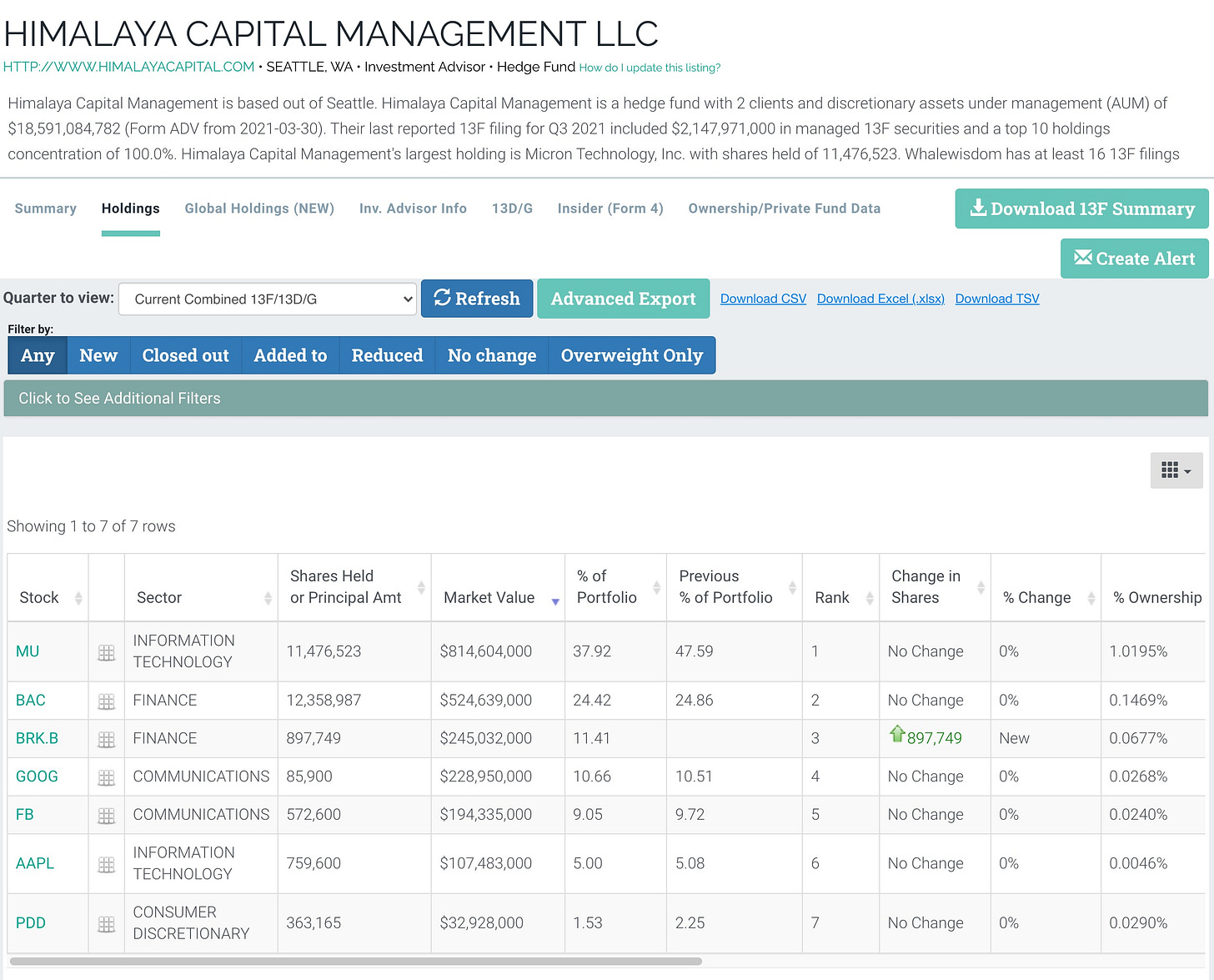

These are people who make large bets on the things they believe in and have the mental fortitude, vision and aptitude to double-down when things become cheaper. Many hold only a few positions at the time. Himalaya’s US reported holdings contain 7 companies, 6 of which sized at 5% or larger, for example. Concentration is a core ingredient of outperformance, but also increases the harm if a single investment doesn’t work out. That’s why being right is ever more important with such a strategy.

Another trait they exude is passivity. Taking an approach that Munger aptly calls “sit on your hands investing”. Their portfolio turnover is typically minor, perhaps including one of two sells a quarter. For Li Lu, that’s a lot actually (from what I can deduce from his US holdings). I aspire to be a passive investor, since it makes the ride so much smoother. Instead of staring at charts all day, it provides the freedom to speak to people, read and listen - to better understand the arena.

In markets we regularly see a “HODL” (hold on for dear life) strategy stemming from ignorance or unfounded hopefulness instead. Social media exacerbates maximalism, where it becomes dangerous to publicly question things or voice an opinion contrary to the common belief. This is thin ice, that the prudent investor must avoid. So you 1) have to ensure you know enough about a topic to ensure you are aware of your blind spots and 2) must always face the facts as they are, not as you’d like to see them.

How does one arrive at conviction and the equanimity that can accompany it? I think it begins with deep understanding of the subject matter. If you know what something is worth, understand the risks and catalysts, and have a reasonable understanding of the potential outcomes and their odds, then that’s a great place from which not to be disturbed by daily volatility.

Additionally, it requires the cultivation of an environment that assists, rather than detracts, from peace and independence of mind. In crypto this is exceptionally hard, as the chad starterpack consists of Twitter, Discord and a plethora of podcasts. A balancing act is thus required. Common tactics can be applied, such as pruning who you follow, limiting the duration and frequency with which you check socials and charts, and ensuring you have time for deep work.

It is counterintuitive that most activity isn’t productive and that instead the optimal way (for my predisposition) might be doing fewer things that matter more. Especially the outward, reactive actions are rarely constructive. I can make fewer buys and sells. Hold fewer positions at larger size. Study particular sectors deeply instead of trying to be a generalist.

Is this true for you too? Something to ponder…

Selected resources

- Li Lu “The practice of value investing” and his Columbia Biz School 2006 lecture.

- Michael Shearn on identifying Mt. Rushmore leaders.

- Munger: “Poor Charlie’s Almanack” (best book on mental models I’ve read).

- Hayden Capital quarterly letters.

Striking Markets Newsletter

Reflections on blockchain, markets and venture capital.