Welcome to Striking Markets

Table of Contents

Why I'm writing this

I’m launching this because I wanted to publicly share my thoughts in an expanded format in complement to my Twitter, as well as steepen my learning curve and credibility by learning in public. Hopefully this will allow those unfamiliar with me to more quickly see what I stand for and my approach to markets.

I don’t intend to prescribe in this newsletter. Instead, I’ll share my experiences and perspectives as I try to make it in this market. Perhaps it will encourage thought for you.

For the past decade I’ve been the owner of multiple small businesses. I’ve bootstrapped businesses, run teams and generally think my strength is identifying opportunities, finding and rallying great people to capture them. I’ve found running businesses and managing teams a very educational experience, however my passion’s increasingly shifted to a hobby I picked up about 5 years ago: investing.

Investing attracted me not only for the financial gains, but also the intellectual stimulation. Learning about industries, businesses, leaders broadly was terribly exciting to me - as it provided an opportunity to understand the world better. And to make money by having convictions that turned out to be right.

I intuitively felt attracted to concentrated value investors with a modern lean. Most of my investment education came from studying long-only investors that contrary to the norm, were willing to invest in technology at valuations that purist value investors (think Munger, Buffett) would scoff at. I think I generally have a stoic, factual approach to life and markets, which combined with my understanding of consumer businesses, entertainment and technology resulted in a track record of >100% CAGR over 5 years in my personal portfolio. I’ve learned so much along the way, many lessons transferrable to crypto - some that I may eventually expound on in this newsletter.

I was first exposed to crypto in ‘17-18, like many of us. Bought the top, sold as I saw better opportunities in equities, where I put all my investment energies in 2018. This shifted in early 2021 however, when I saw the wealth of innovation happening on smart contract chains. The opportunity was too great to pass up and in the following months I had shifted all my investment focus there and gradually increased my exposure to crypto as a whole.

Portfolio management

My approach to portfolio management has been nuanced. I think it’s equally important as investment selection to succeed. Without layers of safety and risk management, it’s hard to make concentrated bets. I’ll share how I’ve done this historically to give you a better understanding of how I invest.

I’ve firstly secured an income via my businesses, secondly put away 1 year of personal expenses in an emergency cash fund, then all the remaining money outside of my businesses I consider investable. Within my investment portfolio I’ve historically held 3-6 companies and a max of 30% cash. I would have crude fundamental valuations for the respective companies and KPIs of my thesis, where I would rebalance into cash or the remaining companies if any company became extreme overvalued (e.g. 100x P/S vs. 25x P/S target) - or exit immediately if my thesis was invalidated.

Coming into crypto, I realized that these markets are both much more volatile than tradfi and that the pace of innovation is so great, that it would take me months to develop competence. My portfolio allocation to crypto would thus have to be gradual. I first set out to understand stablecoin yield farming, allowing the at the time unproductive cash portion of my portfolio to get a yield. Then I began shifting allocation into directional bets on crypto, to the point where I’m now about 27% allocated across my entire portfolio (not counting stables), but am currently targeting 35% exposure. I still hold equities, but imagine their weight will continue to decrease as my confidence towards allocating to crypto increases.

Current allocations

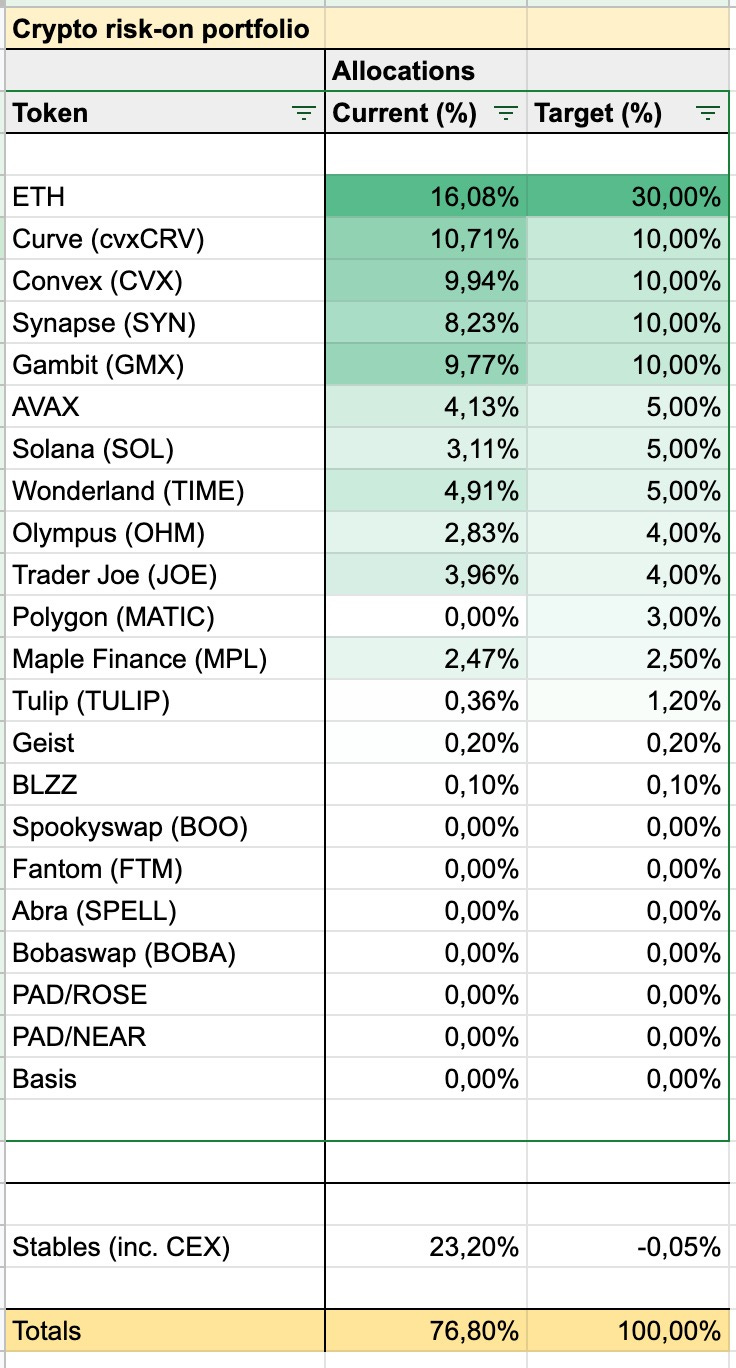

These are my crypto allocations at the moment, which will give you a sense of how I’m positioned and what tokens I’m bullish on:

The difference between the Current and Target allocation is that I rarely take positions at once. Averaging in creates a cost basis that makes it easier to stomach volatility, so I place limit orders on key support levels for most of my entries. Luckily with Gelato’s limit order integration, this is now possible too on DEXes like Spookyswap and Quickswap. The Stables portion represents the cash deployed as such, but explicitly excludes stablefarms. The 0% allocations are some but not all of the tokens I’m watching and opportunistically trading in and out of.

Sizing is increased based on my understanding and confidence in the token, which is influenced by relative valuation, upside potential and price action. The latter is something I’ve had to learn coming into crypto, as I knew little about technical analysis and had simply succeeded at finding value that was eventually uncovered by the masses via some catalytic event. Without sensitivity to price action I think it’s very easy to get killed in crypto, as there are such large discrepancies between fundamental value and price and mimetics can perpetuate these.

For smallcaps, I tend to begin my sizing very small and increase it as my confidence in a team’s ability to execute and market adoption grows. First allocation sizes may be 1.25 - 2.5% of total risk-on portfolio, taken in 2 or 3 buys.

And farming tokens I’ve learned to be careful of. When the market is very bullish, chances of avoiding impermanent loss are greater as people have more risk appetite and there’s less sell pressure. However during market weakness, people rotate into relative strength and these are the first to go down. Combined with the fact that I force myself to size these small, I’ve come to realize they are rarely worth my time, which is better spent understanding the sectors I’m deeply invested in, or those I’m researching for future investments.

Areas of focus

As an investor, I’m currently working on improving the following parts of my process:

- Attention efficiency: Spending my time and energy on the most important things.

- Portfolio management around relative strength: Developing sensitivity around strength of alts vs ETH, then ecosystem tokens vs. their base chain tokens.

- Macro and on-chain analysis to be able to benefit from volatility: Tracking the right metrics to be able to decide when to buy the dip or sell the top, without ending up a turkey eventually (works until it doesn’t).

And understanding the following sectors, trends and narratives:

- ETH scaling solutions: roll-up differences, ecosystems, dApps within those ecosystems and its impact on ETH.

- ETH 2.0 impact on ETH price action.

- Fixed income: Large in tradfi and implementations can spur tradfi adoption and increase crypto TVL. Use cases, implementations (Pendle, Notional, FiatDAO) and how this can be abstracted and simplified to the point retail can adopt.

- Undercollateralized lending: Also large in tradfi and necessary to improve capital efficiency within DeFi (LTV is probably at local maximum since almost all crypto lending is collateralized) and spur tradfi adoption. Use cases, implementations (Maple, TrueFi), CeFi initiatives.

- X-chain liquidity: Removing barriers between chains (esp. EVM vs. non-EVM) via bridging solutions and on-ramping. Implementations (SYN, REN, IBC) and use cases (MiM, xchain yield aggregation).

- Deltra neutral strategies: Exist in abudance within crypto, yet aren’t accessible to retail because of complexity. Implementations (Lemma, Basis) and general incorporation in my investment approach next to AMM LPing and folded lending. Ways to get yield on stables is an interesting topic that I can expand on in the future.

I’m excited by how much there’s to learn and how much of a beginner I still am in this space. Crypto’s been the most exciting industry I’ve ever worked in and I continue to be impressed by the caliber of individual that I meet here - it truly attracts the smartest early adopters and contrarians. There’s so much value hidden in the casino, as Matt Huang so eloquently said.

Crypto may look like a speculative casino from the outside.

— Matt Huang (@matthuang) May 25, 2021

But that distracts many from the deeper truth: the casino is a trojan horse with a new financial system hidden inside.

Excited to bring you along this journey of mine. I’ll write intermittently whenever I’m inspired or feel the need to clarify my thinking. Would love to make this interactive and encourage you to let me know if you’d like me to expand on particular topics or part of my process. You can leave a comment below.

Make sure to follow me on Twitter (@cryptobrucey), as well as Deus Ex DAO (@deusexdao), the ventureDAO that I’m building with some of the sharpest minds in crypto.

Allow us to introduce ourselveshttps://t.co/khewrWNxrE

— Deus Ex DAO (@deusexdao) November 11, 2021

Finally, I will leave you with a striking message from the legend himself.

Yours truly,

Bruce

Striking Markets Newsletter

Reflections on blockchain, markets and venture capital.